Alaska Metals Mining

Last modified: 12th August 2019

Background on Mining

Active Mines in Alaska

Pebble Mine Articles

- Pebble Mine Overview

- Powering Pebble

- Water Management at Pebble

- Block Caving at Pebble ** **

- Mining Claims Near Pebble

- Bristol Bay Fisheries

- Keystone Dialogue on Pebble

- Tailings Storage at Pebble

- Alternative Tailings Storage at Pebble

- Pebble and Perpetuity

- Opposition to Pebble

- Earthquake Risks at Pebble

Other Major Active Mining Proposals in Alaska

Inactive Mines in Alaska

Abandoned Prospects in Alaska

Historical Mines in Alaska

Placer Mines

Outside

Metal mining in Alaska is dominated by gold, silver, zinc, and lead mining, with Large and small metal mines are scattered throughout Alaska ( see map). Metal mining plays a strong but minority role in the state economy (7% of GDP), and is both economically and environmentally controversial.

Mined metal is a valuable export and source of cash income for workers, and mining jobs pay above the state average. Major mines are mostly owned by out-of-state corporations, leading most of their profits to be exported. Excise taxes on mined minerals are low compared to oil production, making mining only a minor contributor to government funds. Several existing mines have caused water contamination problems, which can impact waterways, wild ecosystem health, and fisheries, other industries, and subsistence users.

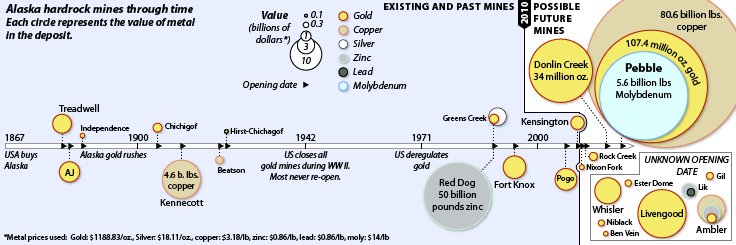

Alaska’s mining history began with gold. Russian exploration for placer gold began in the early 1800’s. The subsequent gold rushes in the 1890’s (perhaps the most famous being the Canadian Klondike Gold Rush) were responsible for a population and settlement boom in Alaska, and contributed to the founding of Fairbanks, Juneau, and Nome. Today, roughly 300 placer mines are still operating and making money in Alaska, but their output in both metal tonnage and value is small compared to the state’s major hardrock mines. The vast majority of metal today is extracted from four large mines, which use open-pit and underground mining techniques to target solid rock ore bodies.

Alaska contains large deposits of metal ore which have never been mined, including copper, gold, silver, and zinc. Exploration for new ore bodies is ongoing.

Major Mines

Alaska has five major metal mines in operation: Red Dog zinc-lead mine, Fort Knox gold mine, Pogo gold mine, Kensington gold mine, and Greens Creek silver mine. Annually, they produced 34 million tons of ore combined in 2012.

Two mines - Kensington and Red Dog - are remote, having no connection to the highway system or to established electrical grids. Fork Knox is by far the largest mine by tonnage; in 2012, it accounded for 70% of the tailings produced. Red Dog is a major global source of zinc: In 2012, it provided 7% of the world’s zinc from its exceptionally rich ore. The rest of Alaska’s mines, large and small, make only a small contribution to world metal supply.

Alaska’s major mines, existing and proposed, are mostly owned and capitalized by outside companies, with the exception of Red Dog, which is half-owned by NANA regional native corporation. Major mines have been proposed that could dramatically expand the industry. Some of these new mines could make noticeable contributions to global metals production. The proposed Pebble Mine, if built, would be one of the largest open pit mines in North America, and would be a major source of gold and copper on the world stage. A rare earth element mine, if developed iin one of Alaska’s many REE deposits, might be strategically as well as economically significant, since virtually all REE production is currently controlled by China.

Economics

Minerals are one of Alaska’s most important exports. The total value of metal production and exploration in Alaska was just over $3.4 billion in 2012, representing around 7% of the gross state product, and producing several thousand jobs. Mining pays a 2% state tax on its revenue.

Due to mines being owned out-of-state and the importance of out-of-state vendors to support and supply mines, it is unclear how much economic value generated by mines is retained in-state. Figures are not available on how many of mine workers who reside and spend their wages in Alaska versus how many live out-of-state.

Controversy

Metals mining is controversial in Alaska. Pebble Mine is the most well-known and controversial mine proposal, since it poses large potential threat to the Bristol Bay salmon watershed, and it is the target of far greater opposition than any other mine project in Alaska history. There are also multimillion dollar lawsuits in-progress over impacts from existing mines such as Red Dog. Much of the concern around mines focuses on impacts (ongoing or potential) caused by water contamination, and its downstream impacts on fisheries, subsistence resources, and general environmental health.

Hardrock metal mining often creates massive long-term environmental economic liabilities, predominantly in the form of toxic tailings impoundment facilities and water-related environmental damages, which may impose major ongoing and future costs on Alaskans, as well as leaving behind physical facilities which in some cases must be maintained indefinitely. Some mining companies have argued that tailings impountdments are an asset, since improved metal extraction may let future miners reprocess the tailings to extract more value. While this may at occur at some point in time, depending on metal prices and technological inventions, tailings impoundments are economic and environmental liabilities for the immediately foreseeable future.

Metal mining has a history of causing severe and long-term environmental contamination outside Alaska. According to the Environmental Protection Agency, mining has contaminated portions of the headwaters of over 40 percent of watersheds in the western continental U.S., and reclamation of 500,000 abandoned mines in 32 states will cost tens of billions of dollars. Within Alaska, most mines and mining prospects have faced similar environmental problems, most notably water contamination, impacts of open-pit mining, and acid mine drainage.

Exploration

Prospectors are actively pursuing new mineral resources in Alaska. 2011 was the record year for Alaska mineral exploration, with $365 million spent on exploration, roughly 10% of the industry’s $3.5 billion economic contribution. Since 2011, yearly exploration expenditures have consistently fallen, reaching a 2014 estimated low of $80-$100 million. The majority of exploration expenditures in recent years have been on the Pebble Mine, Donlin Creek, and Livengood prospects. Work on smaller projects is also proceeding, such as on the Niblack Prospect in the southeast, and the Upper Kobuk Mineral Project in the Interior.

Exploration can be locally lucrative, regardless of whether a mine is built - as is seen in the town of Iliamna, the jumping off point for the massive, multi-year exploration of the nearby Pebble prospect. The recent contraction of the Pebble project also highlights the volatile nature of exploration. After major investors pulled out, the number of Pebble jobs in the region dropped from 1,403 in 2013 to 184 in 2014.

Created: Jan. 19, 2018